Income Based Loan Options

for all Credit Types.

Fast Loans

Simple Process

Low Rates

Low Monthly Payments

Personal Loans from 10-100K

Did you receive an offer in the mail?

Click Here!

Checking your Loan Options will not affect your credit score!

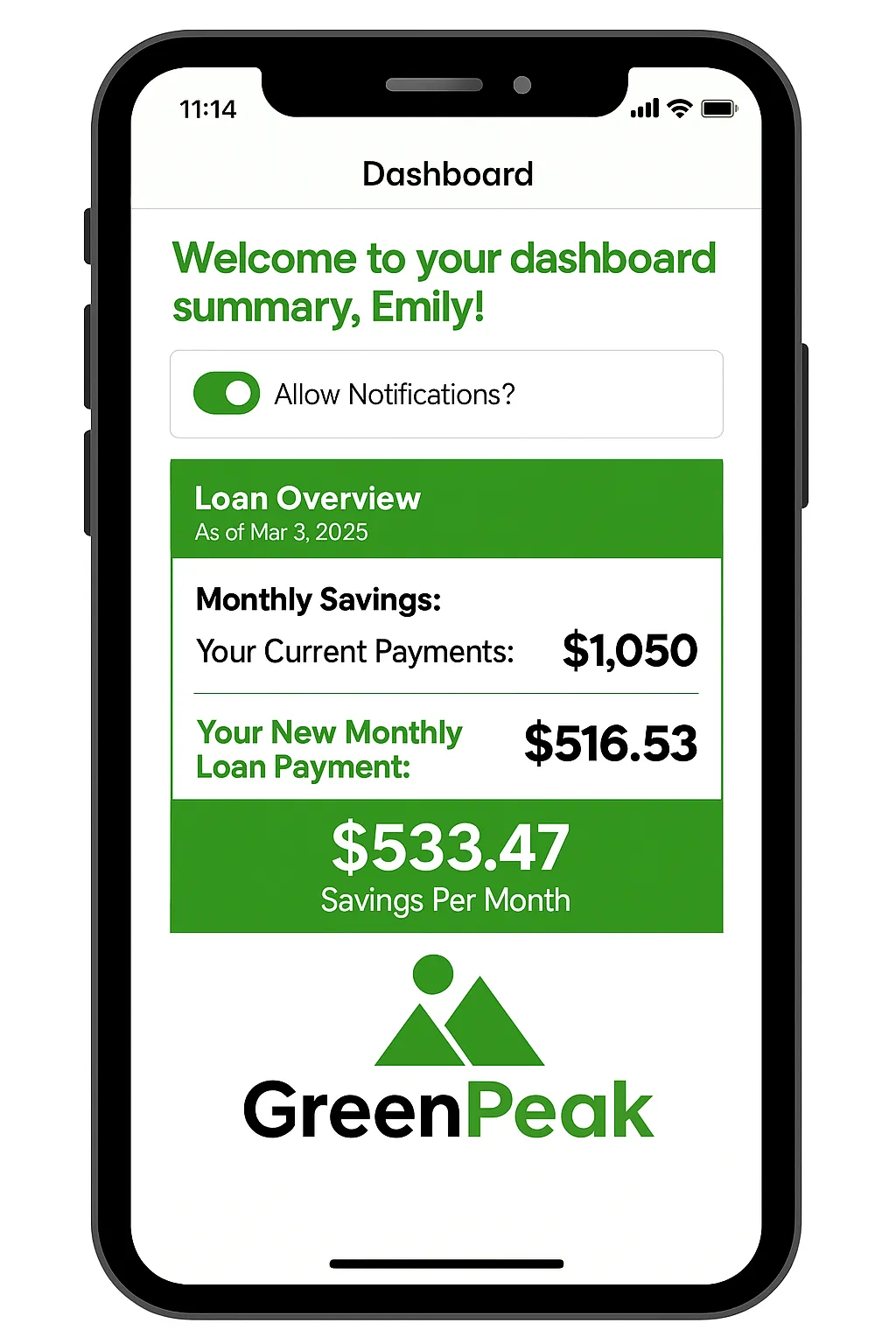

"Loved everything so far"

"I had great income but kept getting denied because I was too close to my credit limits. GreenPeak understood my situation and got me the cash I needed to rebuild my credit!"

Emily, CA

"Fast and Easy"

"They got me the loan I was looking for. It was a pretty fast process, we texted, got on the phone within a couple days" Robert, AZ

"Highly recommend them"

"I was working, paying all my minimum payments but couldn't make a dent on paying these cards down because of the interest, GreenPeak got a loan in front of me so I could have a more reasonable rate"

Rudy, FL

Why GreenPeak?

Why GreenPeak?

GreenPeak Loans specializes in income-based personal loans, making it easier for individuals to access financial assistance. Operating in 48 out of 50 states, they have helped thousands of people with unsecured personal loans to save money, even in situations where they were previously denied by other lenders. Their approach focuses on income rather than traditional credit scores, offering a solution for those who may have struggled with approval in the past.

GreenPeak Loans specializes in income-based personal loans, making it easier for individuals to access financial assistance. Operating in 48 out of 50 states, they have helped thousands of people with unsecured personal loans to save money, even in situations where they were previously denied by other lenders. Their approach focuses on income rather than traditional credit scores, offering a solution for those who may have struggled with approval in the past.

Credit Based Loans

VS

Income Based Loans

Credit Based Loans

Offers are based on your credit score and history

Best for borrowers with strong or improving credit

Can help improve your credit when managed well

Income Based Loans

Approval based on income, not credit score

Great for those with limited or poor credit history

Ideal for steady earners rebuilding financial health

Frequently Asked Questions

What are the personal loan requirements?

To apply for credit, you must be a U.S. citizen and at least 18 years old.

You authorize us to make inquiries and obtain information about you as permitted by law.

A valid bank account and Social Security number/FEIN are required.

Loan terms depend on the requested amount, credit score, usage, and history, and are subject to credit history verification.

You need to be employed or have sufficient income from other sources.

What is an income-based personal loan?

An income-based personal loan is a loan where your eligibility and loan terms (like amount, interest rate, and repayment period) are determined largely by your income rather than just your credit score. Lenders assess your ability to repay based on your monthly earnings and financial obligations.

Do I need a good credit score to qualify?

Not always. While credit score can still play a role, many income-based loan providers consider income and employment stability just as heavily—some even work with borrowers who have fair or poor credit.

Can self-employed or gig workers qualify?

Yes. Many lenders accept self-employed or gig workers, but you’ll need to show consistent income through tax returns, invoices, or bank statements. Be prepared to provide more documentation than someone with a traditional W-2 job.

Does GreenPeak Loans charge any fees to use its service?

GreenPeak Loans does not charge users for using its platform. However, the lender or service provider you connect with through the platform may have their own fees and charges for loans.

Disclaimers:

The purpose of GreenPeak Loans (“the website”) is to connect potential borrowers with lenders and financial service providers. GreenPeak Loans (“the website”) does not provide any offers of credit or solicitations to lend. The website and its operators only provide a service and are not agents, representatives, or brokers of any lender, do not make any credit decisions, and do not charge potential borrowers for any loan or product.

We are paid by Lenders, Lender Networks, and other Advertisers:

GreenPeak Loans (“the website”) offers a free, for-profit, advertiser-supported loan-connecting service to consumers. Lenders in our network and third-party lender networks we use pay us if a lender offers you a loan after reviewing your information through our service. You never have to pay a fee to use our services to connect you to a loan offer. Always review all options available to you and never assume a loan offer you receive is the best loan offer available to you. See our Ad Disclosure for more information.

Personal information and credit implications:

GreenPeak Loans (“the website”) may collect personal information provided by you for the purpose of submitting it to our lending partners. The purpose of this is to obtain consumer report information from your credit profile in order to conduct a credit check, verify your information, review your creditworthiness, prequalify you, and/or determine if you qualify for certain credit terms. You are under no obligation to use this website to apply for credit or initiate contact with any lender.

Late payments or nonpayment of loans may result in additional fees or collection activities, or both, as well as negative impacts to your credit score. Each lender has their own terms and conditions; please review their policies for further information.

Availability:

Residents of some states in the U.S. may not qualify for a loan as a result of certain lender requirements. GreenPeak Loans (“the website”) does not guarantee that submitting your information will result in you being offered a loan product by a lender or being offered a product with the rates or terms you desire. Many factors about you and your loan request information will impact the terms of the loans that may be offered to you. Always review all options available to you and never assume a loan offer you receive is the best loan option available to you.